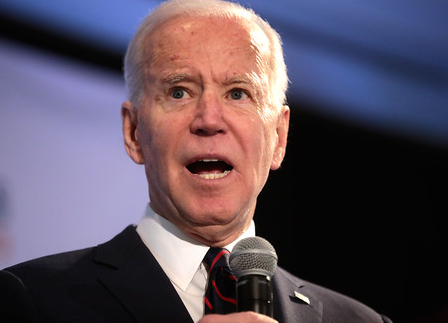

President Joe Biden’s administration has recently revealed new plans to utilize taxpayer funds to alleviate the debts of college-educated voters as the crucial 2024 election approaches.

Biden’s initial extensive plans to eliminate hundreds of billions of dollars in outstanding student loan debts for millions of borrowers were thwarted last year by the Supreme Court.

However, this setback has not deterred the Biden administration from persisting in its endeavors to pardon substantial amounts of student loan debt through alternative, more focused programs. According to the Washington Examiner, on Thursday, the Biden administration introduced another proposal for student loan debt relief that is supposedly directed towards borrowers facing financial difficulties.

As of now, only a few specific details have been disclosed, such as the approximate total of forgiven debt or the criteria for borrower eligibility. The proposed regulation is said to still be under internal deliberation and will go through a period of public comments, both of which could lead to modifications before implementation.

The Examiner mentioned that Department of Education Undersecretary James Kvaal made the announcement regarding the new student loan debt relief proposal in a statement on Thursday, stating:

“College is meant to lead to a better life, but too many students end up struggling due to their student debt.”

“The ideas we are outlining today will allow us to help struggling borrowers who are experiencing hardships in their lives, and they are part of President Biden’s overall plan to give breathing room to as many student loan borrowers as possible,” he added.

“It’s an important part of the Biden-Harris Administration’s permanent solutions to the problem of unaffordable loans.”

The new rule, as reported by The Associated Press, aims to provide relief to various groups of borrowers. The main beneficiaries are individuals who are experiencing financial difficulties that hinder their ability to repay their loans. Determining whether a borrower is facing hardship involves considering a wide range of factors. However, the proposal’s language is described as “expansive” and vague, leaving the final decision on eligibility for relief to the Education secretary.

According to the AP report, additional relief categories for student loan borrowers with outstanding debt include resetting the loan to its original amount to cancel accrued interest, with amounts of up to $10,000 or $20,000 for individual or married borrowers respectively. Furthermore, if the student loan is older than 20 or 25 years, depending on the type of loan, a provision may cancel the remaining balance entirely. The plan also extends coverage to borrowers who attended a “low-value program” and are now unable to afford loan repayments.

In the previous month, Education Secretary Miguel Cardona made an announcement regarding the approval of student loan debt relief. This new plan aims to raise awareness about various existing loan forgiveness programs that borrowers may not be aware of. These programs include relief for individuals who have worked in public service or have attended a school that has been closed and decertified.

The unveiling of this plan is timely, as it follows the recent approval of approximately $4.9 billion in student loan debt relief for over 73,000 borrowers. This relief falls under the income-driven repayment (IDR) forgiveness and Public Service Loan Forgiveness (PSLF) programs. The administration proudly stated that these recent approvals have brought the total relief granted under President Biden’s tenure to over $136.6 billion for more than 3.7 million borrowers.

“The Biden-Harris Administration has worked relentlessly to fix our country’s broken student loan system and address the needless hurdles and administrative inaccuracies that, in the past, kept borrowers from getting the student debt forgiveness they deserved.”

“The nearly $5 billion in additional debt relief announced today will go to teachers, social workers, and other public servants whose service to our communities have earned them Public Service Loan Forgiveness, as well as borrowers qualifying for income-driven repayment forgiveness because their payments are for the first time being accurately accounted for,” he added.

“Thanks to President Biden’s leadership, we’re approving this loan forgiveness while moving full speed ahead in our efforts to deliver even greater debt relief, and help more borrowers get on a faster track to loan forgiveness under our new, affordable SAVE repayment plan.”