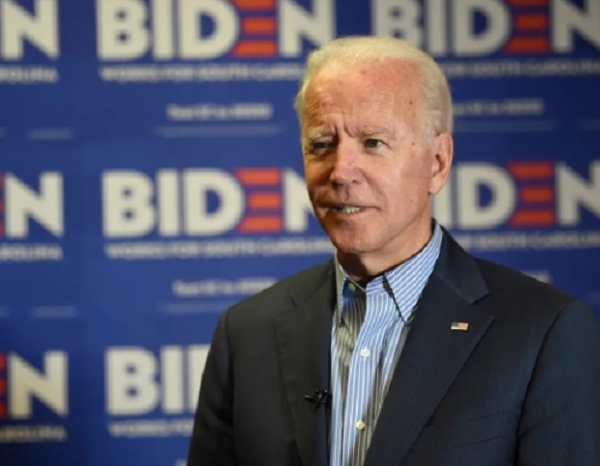

President Joe Biden is set to address class disparities during his upcoming State of the Union speech by proposing significant tax hikes on the ultra-rich and major corporations. As reported by the UK’s Daily Mail, Biden will advocate for raising the tax rate on corporations valued at over $1 billion from 15 percent to 21 percent, a notable increase from his initial proposal of 15 percent. Additionally, he will propose a new 25 percent tax on individuals with a net worth of at least $100 million, recognizing that ‘worth’ typically encompasses more than just liquid assets.

The outlet reported further:

“White House officials said the steps were part of a proposed 2025 budget to be released next week, and aimed at reducing the federal deficit by $3 trillion over 10 years. The tax plans are expected to form a core part of Biden’s re-election campaign, contrasting markedly with presumptive Republican nominee Donald Trump, whose 2017 ‘Tax Cuts and Jobs Act’ slashed taxes on companies and the wealthy.”

“Congressional Republicans want to cut taxes even more for the wealthy and big corporations, all while adding more than $3 trillion to the debt,” Lael Brainard, director of the White House’s National Economic Council, said, per the Daily Mail. “President Biden has made clear whose side he’s on.”

Throughout Trump’s presidency, the Republican-controlled Congress approved the most significant tax reform in many years, reducing the corporate tax rate from 35 percent to 21 percent to enhance the competitiveness of corporations on a global scale. Recent IRS data indicates that the majority of American earners benefited from this tax-cut plan, contrary to the inaccurate assertions made by Democrats that it only favored “the wealthy.”

“Biden also will call for Congress to approve far stricter limits on business income deductions for executive pay, limiting them to $1 million for any given employee,” the Daily Mail reported. “Current law already prohibits deductions on compensation for chief executive officers, chief financial officers and other key positions. White House officials said the new proposal would cover all employees paid more than $1 million, and raise over $250 billion in new corporate tax revenue over 10 years.”

It remains uncertain whether Biden will propose any spending reductions to counterbalance the substantial trillion-dollar deficits he has accumulated in the national debt during his time in office. Traditionally, his party is against cutting benefits programs, regardless of their financial instability.

Nonetheless, Biden’s intentions to tax ‘the wealthy’ may be abandoned soon after a Supreme Court decision deemed his $430 billion-plus student loan forgiveness plan unconstitutional.

The key issue in the case, as per the SCOTUS Blog, is “Whether the 16th Amendment authorizes Congress to tax unrealized sums without apportionment among the states.” This amendment, which permitted the Legislative Branch to legally enforce an income tax for the first time in the nation’s history.

“Biden later proposed a 25% annual tax on all gains to wealth over $100 million in a given year, including unrealized capital gains that aren’t currently taxable. The White House says that the tax would only apply to the top 0.01% of the highest earners. While the proposal faces long odds with a Republican-controlled House of Representatives, it could be nixed permanently if the high court rules such a tax is unconstitutional,” The Washington Examiner added.

Divisive. Unhinged. Drug addled.

Angry.

All things we don’t want in a national leader!

Such an alarming SOTU.