The State of Texas is terminating a huge $8.5 billion investment with trillion-dollar asset manager BlackRock amid a dispute over the firm’s targeting of U.S. energy suppliers.

Texas State Board of Education Chairman Aaron Kinsey stated in an announcement first obtained by Fox Business on Tuesday that the Texas Permanent School Fund (PSF) had notified BlackRock on Tuesday that it was divesting from the asset management firm.

“The Texas Permanent School Fund has a fiduciary duty to protect Texas schools by safeguarding and growing the approximately $1 billion in annual oil and gas royalties managed by the Texas General Land Office,” Kinsey said in a statement Tuesday. “Terminating BlackRock’s contract ensures PSF’s full compliance with Texas law.”

“BlackRock’s dominant and persistent leadership in the ESG movement immeasurably damages our state’s oil & gas economy and the very companies that generate revenues for our PSF. Texas and the PSF have worked hard to grow this fund to build Texas’ schools,” he continued. “BlackRock’s destructive approach toward the energy companies that this state and our world depend on is incompatible with our fiduciary duty to Texans.”

Texas’ action was taken in adherence with a 2021 state statute designed to distance the state and its substantial public funds from financial institutions that are engaging in a boycott of the oil and gas industry. BlackRock is headquartered in New York City.

A significant portion of the $53 billion Texas PSF, which was established in the 19th century to support the state’s public schools, has been divested. Furthermore, this divestment is the largest of its kind since Republican-led states started severing financial ties with BlackRock and other financial institutions in an effort to comply with environmental, social, and governance (ESG) standards.

BlackRock has been accused of pushing ESG policies that undermine U.S. energy production and benefit China.

The world’s largest money management firm with more than $9 trillion under assets, BlackRock has benefited from the Biden administration’s adoption of ESG standards, which impact aspects of the U.S. economic and banking sectors.

BREAKING: Texas is terminating a massive $8.5 billion investment with trillion-dollar asset manager BlackRock.

— Merissa Hansen (@merissahansen17) March 19, 2024

BlackRock is deeply entrenched within the Biden administration and has been pushing ESG policies that give the investment firm more clout over U.S. financial markets.

Biden’s deputy Treasury Secretary Wally Adeyemo was BlackRock CEO Lary Fink’s chief of staff and a senior adviser at the firm. According to Adeyemo’s 2020 financial disclosures, he owns company stock valued at between $250,000 and $500,000.

Another BlackRock alum serving in the Biden administration is former global chief investment strategist Michael Pyle, who was vice president Kamala Harris’ chief economic adviser before stepping down in January. During the Obama administration, Pyle served as the president’s economic policy special assistant.

Tom Donilon served in the Obama, Clinton, and Carter administrations prior to assuming the role of chairman of the BlackRock Investment Institute. His brother, Mike Donilon, is Biden’s senior adviser and former campaign chief strategist. In January, the Donilon brother transitioned from the White House to taking over “functional control” of Joe Biden’s re-election efforts.

BlackRock thus has outsized influence in the Biden administration and is deeply connected to the sitting president’s re-election campaign.

There is evidence that the Biden administration is highly influenced by BlackRock. In March 2023, Biden used his first veto to block a Congressional resolution that would have blocked the Department of Labor’s final rule concerning the consideration of ESG factors in corporate retirement plans in the United States.

“The ESG Rule addresses how a fiduciary under the Employee Retirement Income Security Act of 1974, as amended (‘ERISA’) may invest (and exercise shareholder rights with respect to) ‘plan assets’ in accordance with ERISA’s fiduciary duties when taking one or more ESG factors into account,” a Harvard Law School forum explained. “Absent a Congressional override of the veto, which appears highly unlikely at this stage, the ESG Rule essentially remains in full force and effect.”

BlackRock’s CEO has also become heavily interested in the bitcoin market. In November, the investment firm “filed an application to list an ETF that will hold ether, the native asset for the Ethereum blockchain, and directly track its underlying spot price,” Forbes reported, adding, “Ether immediately surged on the news, jumping almost 10% from $1,880 to briefly over $2,100 before starting to give back some of the gains.”

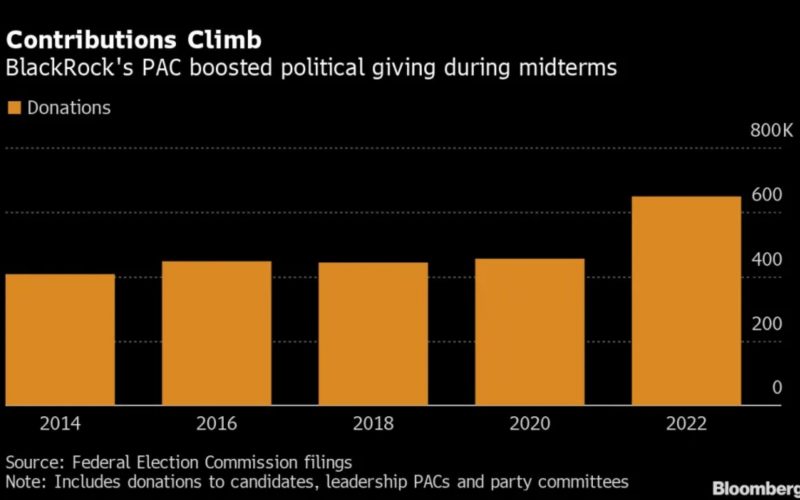

In the midterm elections, BlackRock’s PAC poured millions into candidate races, spending a record amount to publish and air advertising to influence America’s elections.

“The company’s PAC gave $10,000, the maximum, to Senate Majority Leader Charles Schumer of New York and $2,500 to his Republican counterpart Mitch McConnell of Kentucky,” Bloomberg reported.

“Among House members who got the maximum $10,000 donation were members of leadership like Maryland Democrat Steny Hoyer, the House Majority Leader, and Representative Hakeem Jeffries of New York, the Democratic Caucus Chairman. The PAC also gave $7,500 to House Speaker Nancy Pelosi,” Bloomberg continued.

“BlackRock’s PAC also gave to House members who might be committee chairs in January, including Florida Representative Vern Buchanan, who could lead the Ways and Means Committee, and Representative Patrick McHenry of North Carolina, who serves as ranking member of the House Financial Services Committee,” the report added. “Each got $10,000.”

After BlackRock received blowback for being so deeply involved in U.S. election, the investment colossus defended itself.

“Engaging with elected officials is an important aspect of explaining BlackRock’s mission and purpose which includes helping millions of Americans retire with dignity,” Brian Beades, a spokesman for the company, said in a statement.

However, the heavy involvement of major investment players in U.S. politics has a lot of explanatory power for why the Biden administration, and many members of Congress, seem to care more about representing powerful and wealthy interests than those of the American people.