It was another year of Congressmembers making an improbable run of stock market picks, according to a startling year-in-review report from Unusual Whales.

In its fourth year of comparing the Congressional trading record versus the market, Unusual Whales provided the following six takeaways:

- Congress beat the market, once again. Of 100 trading members, 33% beat SPY with their portfolios.

- Democrats beat their Republican colleagues by a massive margin.

- Members are once again trading options, after not trading them in 2022.

- The overall number of transactions by Congress is down. They are also reducing time to disclosure, as well as using the note feature, because people now watch them vigorously.

- There were many unusual trades and conflicts

- If you are a member of Congress or aide reading this report, are embarrassed or want to work with us or fight for market transparency, we can be reached at congress@unusualwhales.com

The detailed report, available at unusualwhales.com, provides many outstanding insights on the trading activities of members of Congress.

Here are the major points, accompanied by graphics from the website.

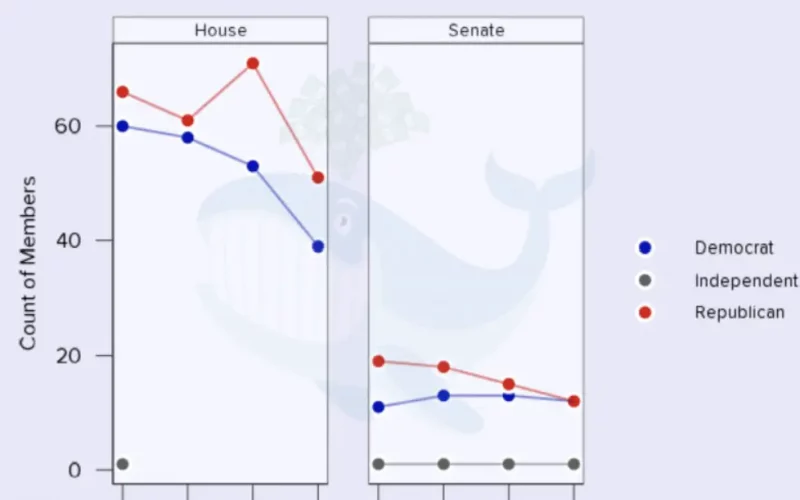

In 2023, there was a steep decline in the number of Congress members disclosing transactions compared to previous years, the report notes.

“A contributing factor was the defeat/retirement of prolific stock traders from years past, such as Alan Lowenthal (572 stock trades from 2020-2022), Jim Langevin (93), Cindy Axne (138), Marie Newman (205), Kurt Schrader (330), Thomas Suozzi (336; and running again!), Chris Jacobs (263), David McKinley (144) and Trey Hollingsworth (69),” the report stated.

Critically, there was a drop-off among Republicans disclosing financial transactions, as illustrated below.

Furthermore, the report noted a general decline in trading activity, likely to be tied to those Congressional members who are up for re-election.

The value of stock market transactions also declined in 2023.

The report provides a note on the overall trend of transactions, which gives Americans a hint of their view of the struggling economy under Bidenomics: “Congress has been selling more stocks than buying in the past couple years. They’ve also been selling more government securities (like Treasury bills, bonds and notes) in 2023 than previous years. They were buying more corporate securities (bonds and notes) in the last two years.”

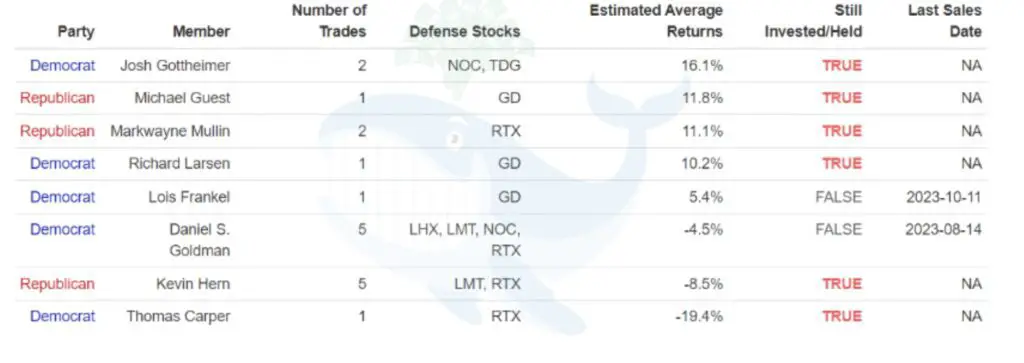

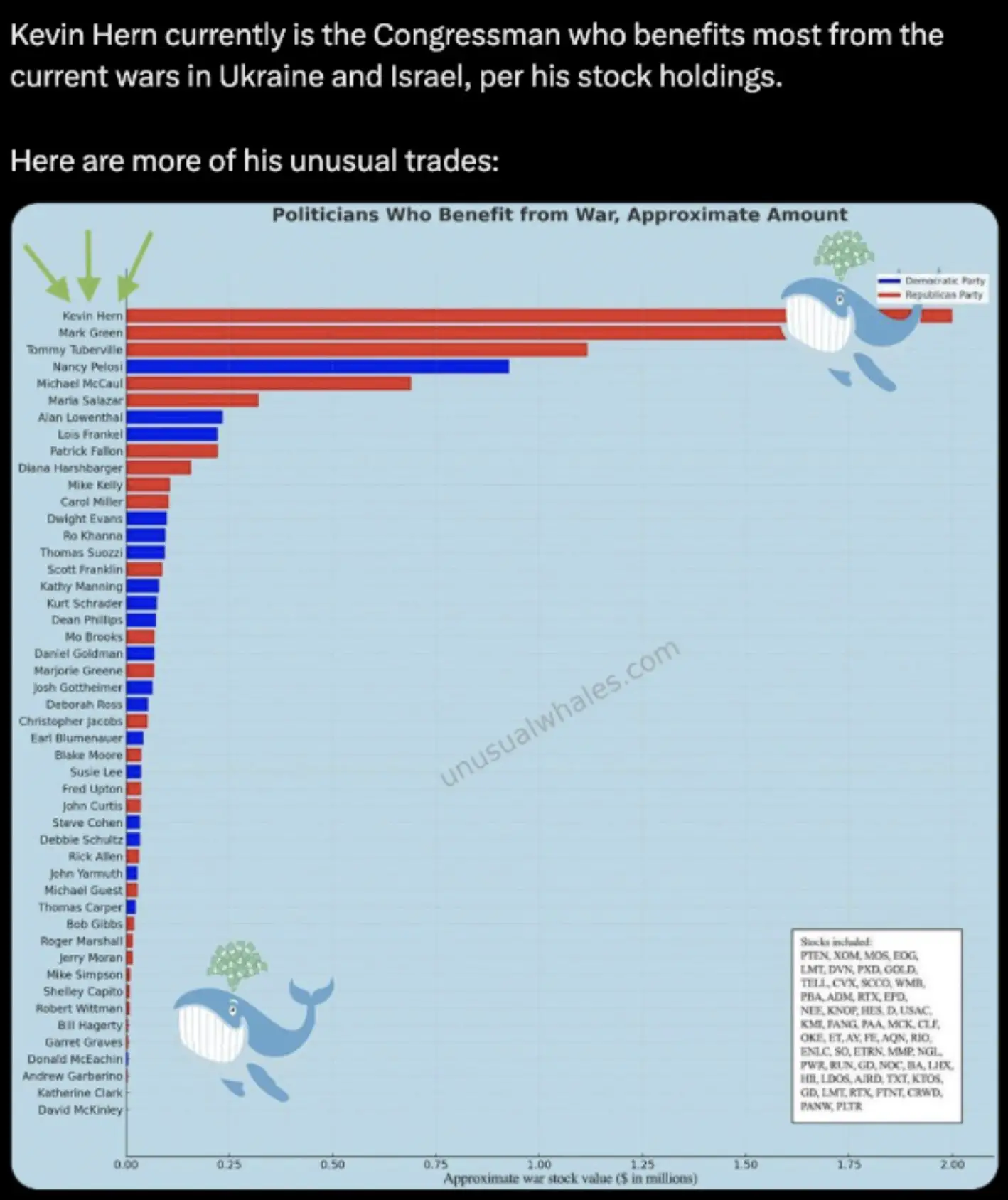

A major theme of the Congressional trading was cashing in on foreign wars.

“Numerous members in Congress traded war stocks before the Israel-Gaza-Palestine conflict. We present the above table without comment, noting that SPY is up only 10% since the conflict, while members who traded these war stocks have often outperformed. We saw something far worse at the start of the Ukraine conflict, which we documented here last year: Ukraine War report.”

The following are reported as the top war-profiteers in Congress. Republicans featured prominently in the report, but Nancy Pelosi led the way among Democrats.

As remarked by Unusual Whales, “After a history of unusual trading, Nancy Pelosi was asked if she thinks US Congress members should trade despite legislative conflicts by Bryan Metzger. She said, ‘We are a free market economy. Congress should be able to participate in that’. Insane.”

The statistics also show that the Democrats have taken over as the top corporatist party in the United States, contrary to the popular culture image of the Republicans being politically in bed with major corporations.

“This year, Democrats absolutely dominated their Republican counterparts,” Unusual Whales remarked on X. “Dems were up 31%, and Republicans 18%. Meanwhile, the S&P500 itself was up 24%.”

This year, Democrats absolutely dominated their Republican counterparts.

Dems were up 31%, and Republicans 18%.

Meanwhile, the S&P500 itself was up 24%.

Many traded despite conflicts in their committees in record numbers.

Read the full report here: https://t.co/zDYDmqpB8u pic.twitter.com/Zo4xssRIOT

— unusual_whales (@unusual_whales) January 2, 2024

In a nutshell, this is likely to continue for the foreseeable future until voters pressure Congressional members to pass legislation that forbids them from cashing in on potential insider-trading through market activity while in office.