The Biden administration may be poised to deal with a major auto workers’ strike by the middle of September, as the ‘big three’ are signaling rising labor dissatisfaction.

The United Auto Workers (UAW) have planned to carry out a strike on September 14 unless they are able to achieve an acceptable deal with Ford, General Motors (GM), and Stellantis.

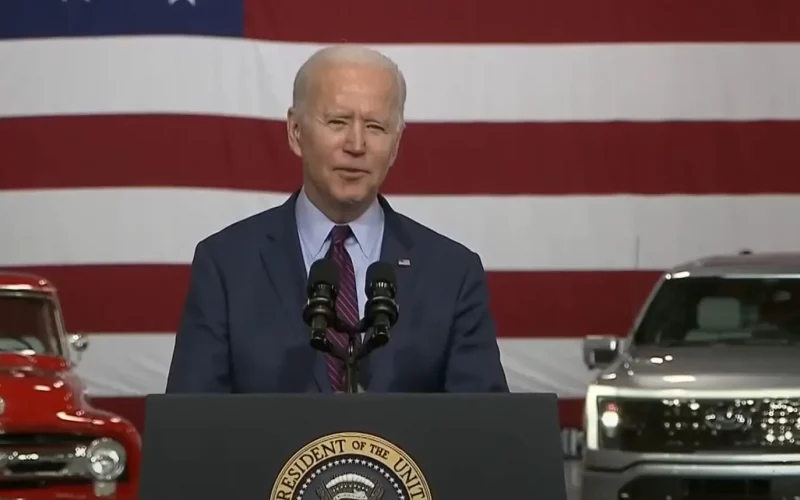

The UAW’s support of President Biden is seen by many as an affirmation of the government’s pro-worker stance.

“We’re focused on winning the best possible contract for our members in 2023, and then we can talk 2024,” the union said in a statement.

“We want to see a federal government that is actively supporting our fight for economic justice in this green transition. Unfortunately, the Biden Administration is pouring billions into these companies’ pockets with no strings attached. A green transition with trickle-down economics won’t work,” the group added.

The White House has maintained communication with the negotiating parties, similar to its engagement with railroad workers who faced a potential strike last year and its involvement in contract negotiations between the Teamsters and UPS, which recently concluded.

On Monday, White House press secretary Karine Jean-Pierre stated, “We’re not going to read out every, every conversation that this President has with parties in these negotiations, but the White House remains in close touch, as we have been in many other, in many of these other discussions with the UAW and the Big Three Automakers.”

UPS Teamsters had asked the White House to avoid interference in their conflict, drawing a parallel between the negotiation and a physical brawl that should remain independent of external parties.

The UAW is promoting several enhancements, including improved compensation, working conditions, and a shift back to defined-benefit pension plans, in contrast to retirement schemes tied to market performance.

The prevalence of retirement plans tied to market performance grew in the U.S. economy last year after the implementation of the Secure 2.0 retirement legislation, which brought substantial advantages for affluent retirees.

The adoption of a defined-benefit pension program could potentially lead to significant changes in the financial structure of the automobile industry. The magnitude of this influence hinges on the particulars of the negotiation, as such plans might compel companies to reserve funds for their employees and families, instead of reinvesting these resources and distributing them through stock dividends.

These modifications could also impact how major automakers allocate dividends to shareholders and structure compensation packages for their executives.

In July, Ford unveiled its dividend announcement for the third quarter, standing at 15 cents per share for both the company’s common and Class B shares.

Reports suggest that Stellantis has provided an update on the negotiation status, indicating that their approach was “productive and cooperative.”

“The discussions between the Company and the UAW’s bargaining team continue to be constructive and collaborative with a focus on reaching a new agreement that balances the concerns of our 43,000 employees with our vision for the future – one that better positions the business to meet the challenges of the U.S. marketplace and secures the future for all of our employees, their families and our company,” Stellantis’ said.

Led by President Shawn Fain, the union is presently attentive to the repercussions of the 2008 financial crisis, a pivotal occurrence that significantly shaped the labor and compensation structure within the automotive sector.

“They got bailed out. We got sold out,” the union said. “The Great Recession turned the auto industry upside down. To save it, autoworkers took massive cuts to their wages and benefits. The companies introduced ‘tiers,’ worse pay for the same work.”

“Pensions were eliminated. Post-retirement healthcare vanished for new hires. Jobs were cut. The companies got billions in taxpayer dollars, while auto workers took deep cuts and made life-changing sacrifices to keep the industry alive,” it added.

Profits within the automotive sector saw a significant upswing amid the pandemic recovery, playing a role in the expansion and continuation of inflationary pressures. During the second quarter, Ford revised its annual profitability forecast to a bracket spanning from $11 billion to $12 billion.

The anticipated free cash flow for the company in the coming months has been redefined within a range of $6.5 billion to $7 billion.

Dealerships are adopting preventive measures, recognizing the potential disruption that would inevitably arise from a UAW strike, affecting production timelines and the timely delivery of orders to their premises.

“Some dealers are starting to plan for the potential of a UAW strike and that is pushing them to the lanes to ensure they have inventory ‘just in case,’” Black Book, an automotive data agency, reported on Tuesday.

Preliminary indications of price impacts are emerging in the wholesale automotive market. Based on figures from Black Book, prices have shown no decline exceeding 1 percent for the current month, implying possible inventory apprehensions within the car sales community.

In the aftermath of the passage of the Inflation Reduction Act, the automobile industry has gained strategic importance in the eyes of the Biden administration. This law incorporates significant tax credits designed to bolster the advancement of electric vehicles as a component of the “green transition,” which seeks to curtail the ecological footprint of the economy.