SWIFT, the global bank messaging network, plans to introduce a new platform within the next one to two years to integrate central bank digital currencies (CBDCs) that are being developed in the world financial system, Reuters reported.

Given SWIFT’s critical position in global banking operations, this move marks a significant step forward for the burgeoning CBDC ecosystem.

With over 90% of the world’s central banks studying digital versions of their currencies, there is a rush to keep up with the developments achieved by bitcoin and other cryptocurrencies. However, technical complexity provide a difficulty.

Nick Kerigan, SWIFT’s director of innovation, highlighted the network’s most recent experiment, which featured a varied group of 38 central banks, commercial banks, and settlement platforms. The collaborative effort centered on interoperability across several CBDCs, even if they were developed on different technologies.

The study also looked at the usage of CBDCs in complex trade or foreign currency transfers, as well as the possibility of automating transactions to speed up procedures and cut costs. The positive findings have inspired SWIFT to contemplate commercializing the new platform over the next 12-24 months, transitioning from the experimental stage to reality.

Meanwhile, the platform’s creation is opportune, given SWIFT’s exposure after its participation in disconnecting most Russian banks from its network as part of sanctions against the invasion of Ukraine.

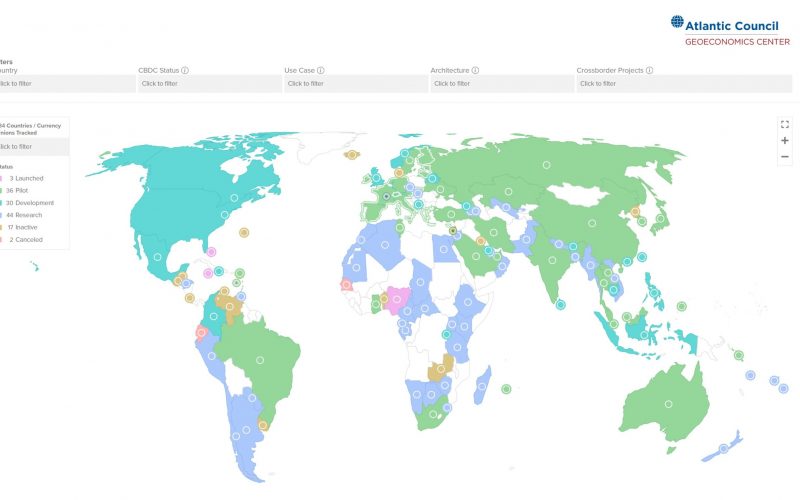

Countries such as the Bahamas, Nigeria, and Jamaica already have working CBDCs, while China is undertaking sophisticated real-world testing of the e-yuan. The European Central Bank is developing a digital euro, while the Bank for International Settlements is conducting many cross-border testing.

The SWIFT network links approximately 11,500 institutions and money in more than 200 countries, allowing billions of dollars to be transferred every day. The projected infrastructure seeks to offer a single worldwide connecting point for digital asset payments, hence improving scalability and efficiency in the banking sector.

According to industry estimates, approximately $16 trillion in assets might be tokenized by 2030, converting them into digital representations for real-time issuance and trade.

While there is currently no imminent plan for the Fed to implement a “digital dollar,” a House bill was filed in 2022 to authorize the Treasury to create one. Rep. Stephen Lynch (D-MA) was joined by four other members of Congress in filing the bill: Jesús Chuy Garcia, (D-IL), Ayanna Pressley, (D-MA), and Rashida Tlaib (D-MI).

“The electronic dollar, a virtual representation of a US dollar, would allow people to make payments using tokens on mobile phones or through cards versus cash,” Lucas Mearian of Computer World reported on the legislation.

“ECASH (electronic cash), as the bill calls it, would be a bearer instrument that wouldn’t require payment processing intermediaries, such as SWIFT, the world’s largest payment messaging network,” the report noted. “That means payments using ECASH would be near instantaneous — even across national borders — and processing fees would likely be dramatically reduced.”

In March 2022, President Joe Biden issued an executive order calling for more research on developing a national digital currency through the Federal Reserve Bank or “The Fed.”

The Executive Order called for the Federal Reserve and the Treasury Department to “Explore a U.S. Central Bank Digital Currency (CBDC) by placing urgency on research and development of a potential United States CBDC, should issuance be deemed in the national interest. The Order directs the U.S. Government to assess the technological infrastructure and capacity needs for a potential U.S. CBDC in a manner that protects Americans’ interests. The Order also encourages the Federal Reserve to continue its research, development, and assessment efforts for a U.S. CBDC, including development of a plan for broader U.S. Government action in support of their work. This effort prioritizes U.S. participation in multi-country experimentation, and ensures U.S. leadership internationally to promote CBDC development that is consistent with U.S. priorities and democratic values.”

The Federal Reserve Bank is still exploring the development of CBDCs. 11 nations thus far have implemented CBDCs, according to the Atlantic Council’s tracker.

The World Economic Forum supports the implementation of CBDCs to promote more inclusion and stability in the global digital economy. It cites America’s central bank, the Federal Reserve, as saying that if CBDC were to be introduced, it would be “the safest digital asset available to the general public, with no associated credit or liquidity risk.”