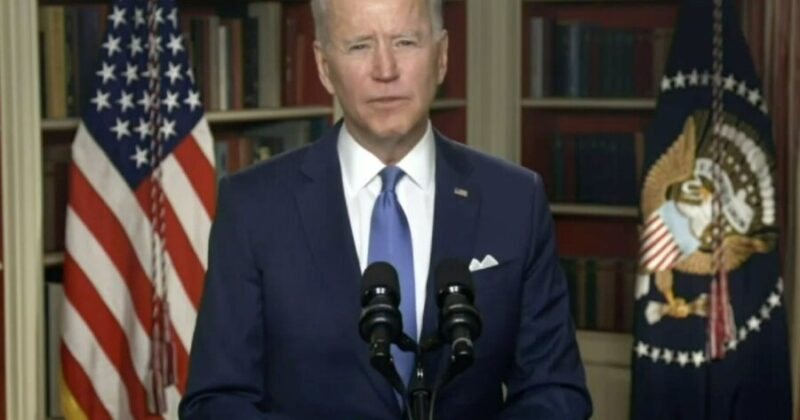

On July 31, President Joe Biden unveiled new rules that will extend student loan debt relief to millions more borrowers.

“Today, my Administration took another major step to cancel student debt for approximately 30 million Americans,” Biden stated.

“We won’t stop fighting to provide relief to student loan borrowers, fix the broken student loan system, and help borrowers get out from under the burden of student debt,” he added.

Beginning August 1, the Education Department will email all borrowers with at least one outstanding federal student loan to provide updates on potential debt relief and inform them of the August 30 deadline to opt out if they are not interested in the program. The email does not guarantee eligibility.

This fall, the department will finalize new rules based on the administration’s ongoing effort to provide $168 billion in student loan relief to nearly 4.8 million borrowers. If the rules are finalized as proposed, more than 30 million borrowers, including those already approved, will be eligible for relief.

“These latest steps will mark the next milestone in our efforts to help millions of borrowers who’ve been buried under a mountain of student loan interest, or who took on debt to pay for college programs that left them worse off financially, those who have been paying their loans for twenty or more years, and many others,” Education Department Secretary Miguel Cardona said in a statement.

In April, the administration released its initial draft rules, instructing Cardona to extend additional student loan debt relief to tens of millions of borrowers across the country, including those whose balances have increased due to years of accumulated interest.

If finalized, the rules would enable Cardona to offer partial or full debt relief to borrowers whose balances have increased since they began repayment, those who have been repaying for over 20 years, borrowers eligible for loan forgiveness who have not yet applied, and those enrolled in low-financial value programs.

The Education Department said that if the rules are approved, the proposed relief will be automatically applied to eligible borrowers.

Borrowers who wish to opt out of debt relief can do so by contacting their servicer by August 30. However, once they opt out, they will not be able to rejoin the program.

To date, the Biden–Harris administration has approved $69.2 billion in relief for 946,000 borrowers through adjustments to Public Service Loan Forgiveness, $51 billion for over a million borrowers through changes to income-driven repayment counts, and $28.7 billion for more than 1.6 million borrowers who were “cheated by their schools, saw their institutions precipitously close, or are covered by related court settlements.”

The administration has also provided $14.1 billion in relief to over 548,000 borrowers with total and permanent disabilities and $5.5 billion to 414,000 borrowers through the SAVE Plan.

“From day one of my administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity,” Biden said.

“I will never stop working to make higher education affordable and to make sure our administration delivers for the American people,” he added.

Share your thoughts by scrolling down to leave a comment.

Where is the House? Control the money!